In recent times, the pound has faced significant challenges in addition to disappointing economic indicators. The escalation of the Russo-Ukrainian war has had a negative impact on the currency, leading to a decline in its value against major currencies such as the US dollar.

The British Economy: A Mixed Picture

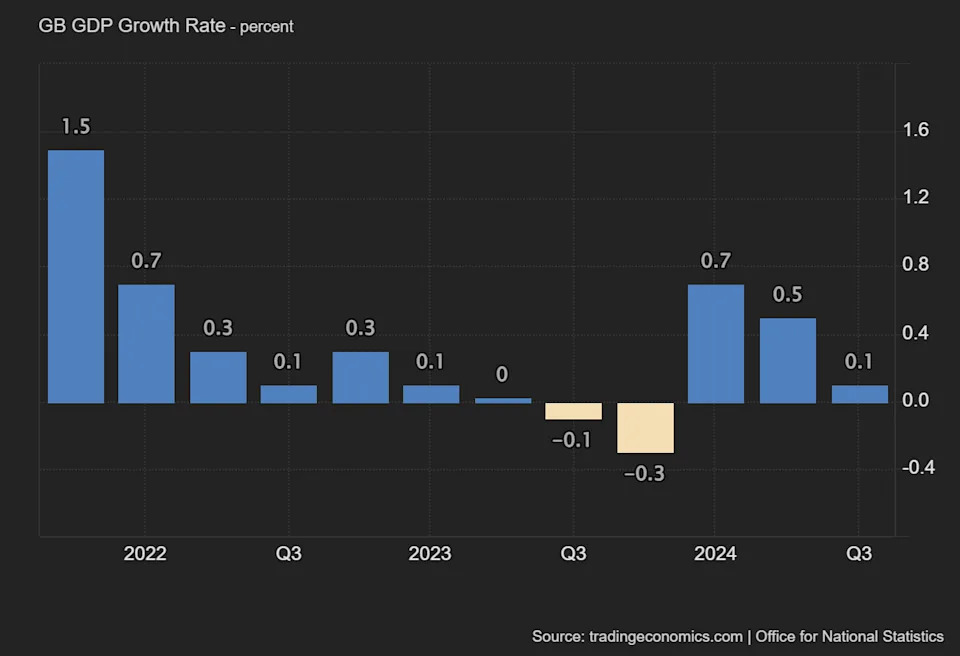

The UK economy experienced a mild recession in the second half of 2023, which ended in the first quarter of this year. However, growth in the third quarter seems to have declined more than expected, with a consensus preliminary figure for GDP of 0.2%. This slight miss is significant given the lukewarm business and consumer sentiment, as well as limited discretionary spending due to high inflation.

Higher Inflation: A Challenge for the Bank of England

In October, inflation ticked up to 2.3%, which was 0.1% higher than the consensus. Annual core inflation also increased to 3.3%. These developments may lead the Bank of England (BoE) to reassess its policy stance, particularly given the strong growth in average earnings.

Expectations for Monetary Policy

The probability of a rate cut on December 19 has declined sharply in recent weeks, with expectations now less than 20%. The BoE’s decision will be influenced by the need to balance economic growth and inflation. In comparison to other major central banks, there is more pressure on the BoE to cut rates due to weaker UK growth.

Retail Sales and PMIs: Key Indicators

Traders are focusing on upcoming retail sales and PMI data from the UK, which will provide insight into the economy’s performance. This information will be crucial in determining the direction of monetary policy.

Opportunity for Cable to Rebound

The pound has experienced significant losses against the US dollar in the third quarter so far. However, with the BoE now less likely to cut rates next month and only two cuts expected next year, there is a question mark over whether further strong losses are justified.

Technical Analysis: A Look at Cable’s Charts

The price of cable has been trading around the 50% monthly Fibonacci retracement level, which serves as significant support. The slow stochastic indicator shows an oversold signal after its recent crossover on November 18. If the next interaction with $1.27 leads to a breakout above, it may lead to a pause before the next possible movement lower.

GBPJPY: An Uptrend Still in Place

Compared to cable’s performance against the yen, the pound has fared better in the third quarter so far. The Bank of Japan’s governor, Kazuo Ueda, recently reiterated that any further rate hikes would be gradual and according to economic conditions. ¥205 may represent a level for potential governmental intervention.

Key Levels and Technical Indicators

¥195 is an important resistance and technical reference in late September and much of last month, coinciding with the value area between the 50 SMA from Bands and the 100 SMA. The current situation favors the carry trade due to the significant differential, which seems unlikely to change drastically within the next several months.

Conclusion

The pound faces challenges both domestically and internationally, with the escalation of the Russo-Ukrainian war contributing to its decline against major currencies. However, there is a possibility for cable to rebound depending on upcoming data, particularly retail sales and PMIs from the UK. The BoE’s decision on monetary policy will be critical in determining the direction of the pound.

Michael Stark: Analyst at Exness

This article was written by Michael Stark, an analyst at Exness. The opinions expressed are personal to the writer and do not reflect those of Exness or FX Empire.

Disclaimer

The information contained in this article is for general information purposes only. It should not be considered as investment advice. Trading involves risk, and you may lose some or all of your initial investment.

Exness: A Leading Online Broker

Exness is a leading online broker offering trading services to clients worldwide. The company provides access to a wide range of financial markets, including forex, commodities, and indices.

FX Empire: Your Source for Financial News

FX Empire is a leading source of financial news, providing up-to-date information on the latest market trends and analysis. Our team of experts delivers in-depth insights into the world of finance, helping you make informed decisions about your investments.